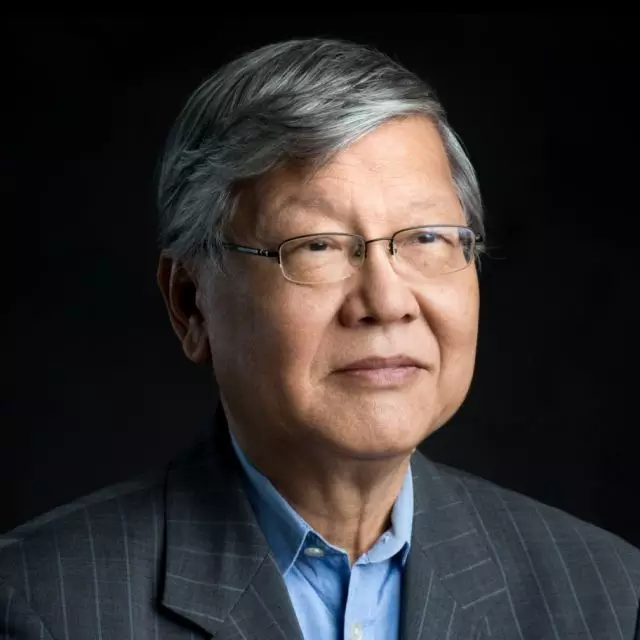

Andrew Sheng, Distinguished Fellow of Asia Global Institute, talks about the need for a global set of monetary rules for the collective good.

Spring is the time for conferences. I was lucky to join two excellent conferences last week: one in Singapore organised by the Nanyang Technological University's Para Limes Institute, on "Silent Transformations", followed by one on "Advancing Asia - Investing for the Future", organised by the International Monetary Fund and the Indian finance ministry in New Delhi.

Para Limes is an institute dedicated to complexity studies - the idea that we cannot see the world from partial analysis, but must take into consideration the interconnected whole. Professor Geoffrey West, former president of the Sante Fe Institute (the first of the complexity institutes founded by the scientists who participated in the Los Alamos nuclear programme) and a leading thinker on growth, innovation and urban life, delivered a brilliant view on the sustainability of present growth models.

Modern life and culture is increasingly urban, because the larger the city, the more efficient the usage of energy and resources, but there are costs in terms of pollution, crowding and spillovers. In other words, growth accelerates exponentially until the economy reaches maturity and slows down, and if there is no longer innovation and change, growth can even become negative. Life follows an S-curve and therefore growth can only be sustained with continued innovation and reform - exactly what the Chinese are attempting.

West's ideas resonated with me during the "Advancing Asia" conference, where the future of India was a major theme. India is today one of the youngest (in terms of demographic labour force) and fastest-growing growth stories. By 2050, it will have the largest population in the world. Without doubt, Indians intend to use 21st-century technology to leapfrog traditional forms of growth, including development through knowledge and services.

In contrast, the Chinese economy, currently the world's No 2, is slowing and also ageing. In Beijing, the world sighed with relief as Premier Li Keqiang (李克強) pledged to uphold steady growth, renminbi stability and continuous reform. As oil prices seemed to stabilise at around US$40 per barrel and the US Federal Reserve committed to slower interest rate adjustments, financial markets actually turned back upwards.

The Delhi conference was marked by high-quality debate on the future of growth models. The key question before us is whether Asia, as one of the fastest growth regions, can overcome global debt deflation. There is an existential question that the West (advanced countries including Japan) is unwilling to address. Reserve Bank of India governor Raghuram Rajan, arguably one of the most thoughtful central bank governors, posed the question as the "elephant in the room."

The basic question is why current growth is slowing and what policies we can adopt to get out of this debt deflation trap. The advanced countries refuse to adopt fiscal expansion, because of internal politics and the growing debt overhang. Increasingly, they use quantitative easing or unconventional monetary policy to try to expand aggregate demand. The trouble is that such a tool is outliving its usefulness, and has very negative spillovers on emerging markets, such as volatile capital flows.

The unspoken policy conundrum is that advanced countries refuse to admit that these spillovers matter. Firstly, these spillovers are notoriously difficult to measure accurately. Secondly, central banks owe their allegiance to domestic authorities and would ignore pleas by neighbours or foreigners.

Thirdly, no one wants to admit that quantitative easing basically amounts to currency depreciation, which then forces emerging markets to also devalue in order to maintain their competitiveness.

Rajan's view is that we can no longer ignore the elephant in the room. If we do, the whole system could degenerate into global deflation or worse. Hence, he argued, we need to start a conversation on how to grow stably and sustainably together, with a consistent set of international monetary rules.

The Delhi conference laid out the fundamental dilemmas in today's growth trap. Monetary and fiscal policies are conducted through national agendas, which have spillovers onto others, but these policies do not add up. Both the theoretical and geopolitical framework are partial, interactive and contradictory, because what is right for a single country can be wrong for the system as a whole.

Partial views are like blind men trying to describe an elephant. None of them gets it right. Partial or silo views end up with individual action or no action that may be collectively wrong. For example, former Fed chairman Ben Bernanke famously argued in 2005 that the US lost monetary control because of emerging markets' excess savings. From a system point of view, this is like an elephant complaining that it has become fat because the grass is growing too much. The grass grows because the elephant fertilises the plain, whereas the gas it emits increases the carbon in the atmosphere. Indeed, if there is too much liquidity provided, some of the smaller animals get drowned.

The renminbi faces a similar dilemma. If it devalues, Chinese trade will recover, temporarily, but if everyone devalues at the same rate, there will be no advantage. However, China will have to undergo even more painful deflation with a stable exchange rate against the US dollar. Because of China's size, many of its trading partners could be hurt if it slows further. Collectively, the current global monetary rules do not acknowledge collective action to help make such adjustments more smoothly.

There is an old African and Asian saying that when elephants fight, the grass gets trampled. The grass gets trampled even when elephants are dancing. We need collective and mutual understanding to get out of the oncoming global deflation. But leadership and statesmanship are scarce when the dark clouds loom. For the next year or so, electioneering and partisan views will trump moderation and mutual understanding.

When bull elephants like Donald Trump trumpet their charge, beware of global consequences.

Distinguished Fellow, Asia Global Institute

Room 326-348, Main Building

The University of Hong Kong

Pokfulam, Hong Kong