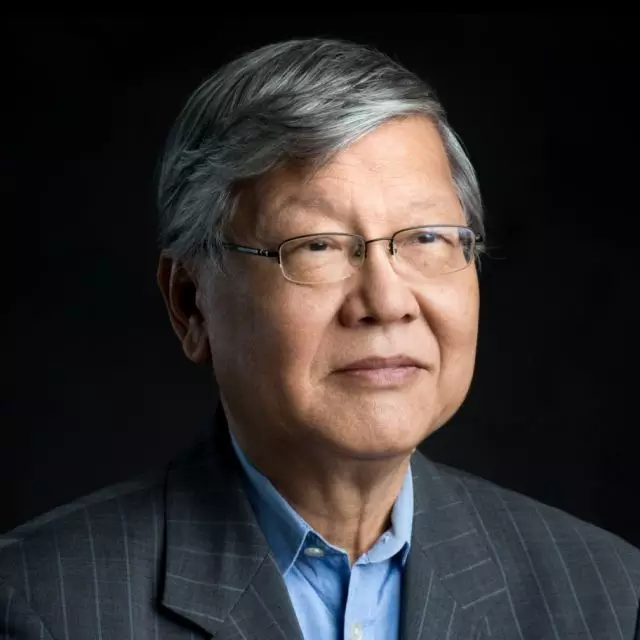

Andrew Sheng, Distinguished Fellow of Asia Global Institute, says painful restructuring is the only way the region's population giants can move beyond the middle-income trap.

As we settle down for the year end, the picture on the economic front seems a bit clearer, although on the political front, the Paris attacks, the downing of a Russian jet by Turkey and continuing refugee migration into Europe have escalated the geopolitical risks. As the "war on terror" spreads, consumer confidence in Europe is likely to suffer, depressing an already weak recovery in Spain, Italy and Ireland.

In a speech this month, US Federal Reserve vice-chairman Stanley Fischer was surprisingly upbeat, noting that Asian growth had slowed, but was still impressive. The pattern of growth in Asia has been quite consistent - a period of fast growth before deceleration to a moderate level, and when the economy reaches maturity, as in the case of Japan, a phase of slow growth or stagnation takes hold.

Fischer explained the growth through two major drivers - trade and demographics. A reason for the Asian success story was the rise of export-driven manufacturing. In the wake of the global financial crisis in 2007, imports to the advanced countries declined. This was compensated for by China's imports of commodities. But once the investment-led cycle in China turned, commodity prices declined sharply. Today, demand from the emerging markets has also fallen. Basically, despite massive monetary creation, the world is facing slower growth with very little inflation in sight, namely, secular stagnation.

The second factor for the current situation is demographics. East Asia enjoyed a demographic dividend: a flood of young workers emerged as global exports took off. But the advanced economies of East Asia are ageing, just like the advanced countries of Europe.

At the same time, with their younger populations, India, Bangladesh, the Philippines, Indonesia and Malaysia still enjoy potential for high growth. With the right infrastructure and policies, they have the potential to grow above 5 per cent per annum. We cannot underestimate the power of these emerging population giants as new engines of growth.

One factor weighing down markets is the trajectory of interest rates, which are still historically low. The Fed may be interested in raising them back to normal, but the European Central Bank and Bank of Japan are still committed to quantitative easing. Emerging market interest rates and corporate borrowing rates have already started rising worldwide and this is, in the short term, negative to growth recovery.

Getting these population giants to move beyond the middle-income trap requires huge reforms in many areas, including the power to put in infrastructure, educate the labour force and deal with structural impediments. Countries like the Philippines and Vietnam are using external pressure, such as signing up to the Trans-Pacific Partnership, to push through reforms.

But the headwinds against these changes are not small. Each country faces its own set of obstacles. In some, it is antiquated labour and land laws; in others, corruption, inefficient state-owned enterprises, and lack of infrastructure. In many, the transaction costs of doing business remain too high to compete effectively.

All these risk factors collectively produce a global secular stagnation trap, very much like the 1930s, when no single government was strong enough to pull the world out of the global depression.

The US today is no longer in the position to be the lead engine. Even though it is recovering, US consumers are spending less on hardware imports and more on domestic services.

What can Asian countries do to get out of secular stagnation? The answer lies in their willingness to reform and restructure an overdependence on exports, debt and resource exploitation. The willingness to bite the bullet will produce a J-shaped recovery, rather than the current L-shaped stagnation.

But every leader knows that reform is politically unpopular because it hits various vested interests. Leadership in these times requires guts and will. The only problem is that it often takes someone else's guts and the need to write the reformer's own political will.

This article first appeared in the South China Morning Post on November 27, 2015 as How Asia Can Move from L-shaped Stagnation to a J-shaped Recovery

The views expressed in this article are the author's own and do not necessarily reflect Asia Global Institute's editorial policy.

Distinguished Fellow, Asia Global Institute

Room 326-348, Main Building

The University of Hong Kong

Pokfulam, Hong Kong