Asia Global Institute's Distinguished Fellow Andrew Sheng and Professor Xiao Geng call for more equity and liquidity against long-term lending for infrastructure investments.

There is a growing awareness that, in today's globalized world, financial markets are beyond the control of national policymakers. While a few economies do have the scale to shape interconnected global markets, they face serious constraints, political and economic. As a result, the global economy is stuck in a pro-cyclical financial cycle, with few options for escape.

As Claudio Borio pointed out years ago, the global financial cycle is longer and larger than real economic cycles, and is closely associated with the fluctuating value of the dominant reserve currency, the US dollar. When the dollar is weak, capital flows from the United States to other countries, where it spurs growth through increased credit.

Unfortunately for these countries, typically in the emerging world, the inflows also spur inflation, asset bubbles, and currency appreciation. The result is growing financial and geopolitical risk, which makes the US dollar more appealing for investors. As capital flows back to the US, the dollar gains strength, while emerging economies are left to face the consequences of bursting asset bubbles and currency devaluation.

This article first appeared in Project Syndicate on April 25, 2016.

The views expressed in this article are the author's own and do not necessarily reflect Asia Global Institute's editorial policy.

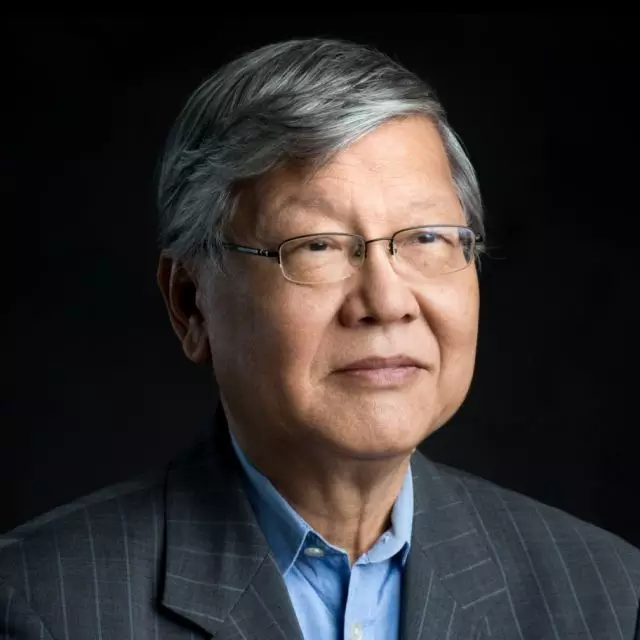

Distinguished Fellow, Asia Global Institute

President, Hong Kong Institution for International Finance

Room 326-348, Main Building

The University of Hong Kong

Pokfulam, Hong Kong