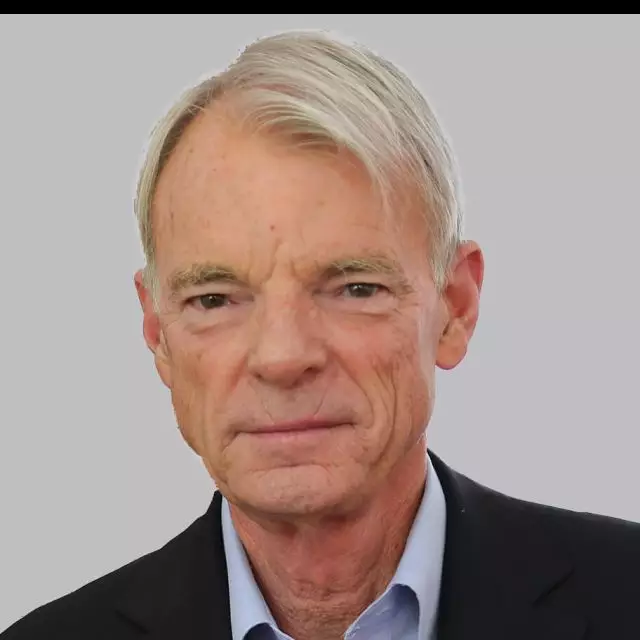

Michael Spence, Advisory Board Co-Chair of Asia Global Institute, examines the forces behind China's market volatility.

Markets plunged again this week, a mini quake with the apparent epicenter in China. The question on the minds of economic policy makers and investors is what is going on and what will the future hold?

It would be tempting to attribute all of this to fears of faltering growth and imbalances in the Chinese economy. But that can't be right. The Chinese economy, at roughly three quarters the size of America's and Europe's, is systemically important. But even an extreme slowdown in China would not derail the whole global economy.

The overriding context appears to be extreme uncertainty about the causes and consequences of these moves, leading to very high volatility.

It seems natural to ask whether the perceived trajectory of the global economy has shifted downward as much as the movements in the equity markets might seem to suggest. The answer seems clearly to be no.

This article first appeared in the Huffington Post on August 25, 2015.

The views expressed in this article are the author's own and do not necessarily reflect Asia Global Institute's editorial policy.

Advisory Board Chairman, Asia Global Institute

Room 326-348, Main Building

The University of Hong Kong

Pokfulam, Hong Kong